Your happiness does

not have to wait for

CIBIL score.

Get instant personal loans for upto ₹15 lakhs with minimal

verification. Quick and hassle free.

Get a

pre-approved personal

loan upto ₹15 lakhs

in just

5 minutes.

Vintage Finance offers instant short-term loans in order to make your life simple.

We have innovative solutions to limit you from facing a money crunch. We

ensure that our customers have sufficient funds to shop, socialize, travel

and pay their bills on time with their instant loans.

Explore our loan products

You can get a loan against property, personal loans for domestic or international

vacation, wedding, to buy a latest gadget, higher education, purchase of vehicle

or even home renovation. Vintage Finance personal loans will help you fulfil your

dreams at in 3 quick steps.

In the time of need,

you can count on us !

Vintage Finance personal loan serves multiple purposes and is available for

all salaried individuals. Life can throw up a surprise any moment in the form

of opportunities or challenges. Thus, from financing a wedding, travel, child’s

education, vacation, medical emergency, any big-ticket purchase, home

repair or even debt consolidation – we are here for you.

Marriage Loan

Medical Loan

Mobile Loan

Two-Wheeler Loan

Debt Consolidation

Loan

Debt Consolidation

Loan

The Vintage Finance

Privileges

Why are we the best?

With an aim to provide hassle free instant loans to borrowers our loan products can be availed within 24 hours without physical verification and with minimal documentation.

100% PAPERLESS &

ONLINE APPROVAL

No loads of paperwork. Just

apply, upload and get approved.

No Credit History

Required

Even if you don’t have any credit history, you can make one by taking a.

QUICK DISBURSAL

Get the funds in your account

within 2 days of approval

Low Interest rate

Flexible and attractive

interest rates

Personalized and Flexible

Spend money in your own way with

flexible personal loan amounts.

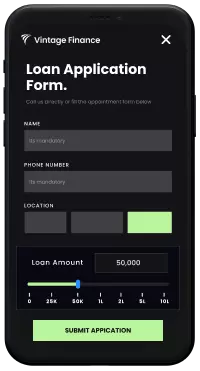

You are just 3 steps away

to get an instant loan

upto ₹15 lakhs

Know what makes us different and why our customers find us as the best of the competition.

Fill application

form

Just Login through our website and

easily fill our loan application form,

using a desktop or a mobile device.

It just takes 5 minutes to complete

the process.

Upload and

verify KYC Docs

Upload all your relevant documents

and proceed to document verification.

Get Instant

loan approval

Complete the application process and

get your loan approved within 15

minutes. Get the funds and use it as

per your convenience.

We provide 24/7 Funding Support. Quick Loan Application form.

Our numbers tell

stories of brilliance and

customer delight.

28 YRS

Total Experience

250000+

Vintage Finance catering

to all finance needs

320000

Loyal Customers

(Follow our easy, convenient and a seamless 3

step loan application process)

12000+

Channel Partners

320000+

Customers have

got Loan approval

in just 5 minutes.

Ready to get

started?

Customers

Reviews and Ratings

We take immense pride in what our

customers have to say about us and our

services which drives

us to put in extra efforts

in delivering the best.

About Us

You no longer need to compromise with your life. With

Vintage Finance, life is easy.

We are a team of experts working on a mission to

bring transparency, ease and integrity in the way

people borrow money.

We have a nationwide presence with a thriving team of 350+ employees across all cities. Vintage Finance provides financial services to help you achieve your financial goals. From your ideal home to the finances you need to set up your own business, we offer loans that are hassle-free and tailored to your requirements.

Our fairness and legacy of hiring and training the best minds with sharp analytical skills, distinguishes us from all others. Excellence and ethics is at the core of everything we do.

Apply now & get loan upto ₹15 lakhs without CIBIL.

Apply loan and make your dreams come true on easy and affordable EMI

Our Channel Partners are earning ₹150000 p/m

To know more about the DSA program, click now,

Frequently asked questions ?

To help you with your decision, we’ve compiled a list of frequently asked questions and answers regarding personal loan.